|

|

| |

|

|

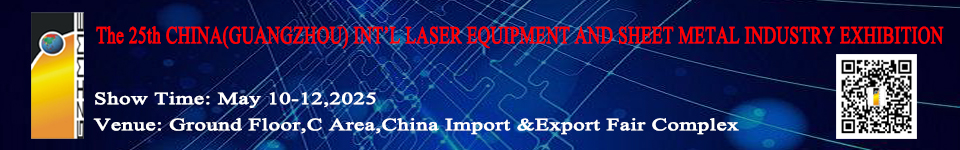

Firming up of steel prices requires global market stability ¨C Mr Sushim Banerjee- The 19th China£¨Guangzhou£©Int¡¯l Sheet metal machinery,Forging, Stamping and Setting Equipment Exhibition

7/27/2017 Sheetmetal machinery, Forging, Stamping expo |

--------------------------------------------------------------------------------------------------------------- |

|

Mr Sushim Banerjee DG of Institute of Steel Growth and Development in his

personal capacity wrote for Financial Express that currently, Indian steel industry

faces new sets of challenges. Thanks to the prompt trade measures undertaken

by the government that the unabated flow of cheap steel imports into the country

that seriously threatened the survival of steel producers, big or small, were

stopped.

Currently, Indian steel industry faces new sets of challenges. Thanks to the

prompt trade measures undertaken by the government that the unabated flow of

cheap steel imports into the country that seriously threatened the survival of steel

producers, big or small, were stopped. Fortunately, it was not India alone, many

other major steel producing countries like the US, Canada, EU, Japan, South

Korea, Turkey and Vietnam were fighting the challenge of low priced imports from

China, Ukraine, Russia by adopting anti dumping and countervailing duty

measures and could successfully block these imports. The net impact of this brief

period of protectionism that has been prodded up with a little bit of emotional

appeal by the new president of the US witnessed firming up of prices of all

categories of steel. The positive price movement in steel had pulled up prices of

iron ore, coking coal and also scrap, but these prices were more impacted by

infrequent problems relating to flooding of mines and logistic bottlenecks. Thus, an

overall upward price movement in the global market had enabled all the major

steel producing countries to derive reasonably better realisation for their end

products, both in the domestic market and in exports.

As global crude steel production at 836 million tonne at the end of first 6 months of

the current year shows a 4.5% rise over last year, a perception is gaining ground

that steel industry is going to experience an upward tick in the coming months.

Here lies the stiff challenge before the industry what is happening in the demand

front? China¡¯s production at 419.7 million tonne at a 4.6% rise in the first 6 months

comes to 850 million tonne productions (minimum) on annualised basis and this

has been triggered off by a substantial infrastructure stimulus provided by the

Chinese government. It has helped merchant iron ore prices moving up from USD

56 per tonne cfr China to USD 65 per tonne in the last few days. Similarly, coking

coal prices have reached around USD 170 per tonne fob Australia from USD 143

per tonne a few weeks earlier. It is reported that steel market in EU is exhibiting

signs of revival, albeit not substantially. North American market shows increasing

PMI in June 2017. Thus, global steel production growth in anticipation of market

growth has not allowed the prices to come down. Steel prices in Indian domestic

market have come down in the last 6 months.

Rates of average HR Coils of 2.5mm have fallen by 8%, from INR 44,500 per

tonne (including taxes and duties) in January 2017 to INR 41,000 per tonne in

June 2017. Prices of average CR Coils of 0.63mm have fallen by 8%, from INR

50,500 per tonne in January 2017 to INR 46,500 per tonne in June 2017. Cost of

average GP of 0.63mm has fallen by 3.5% from INR 57,500 per tonne (all

exclusive) in January 2017 to INR 55,500 per tonne in June 2017. In the long

products, the drop in average prices in TMT 12mm from INR 37,700 per tonne in

January 2017 to INR 36,300 per tonne in June 2017 by 4% is comparatively lower

than flat product prices. The average domestic prices of Wire Rods 12mm fell from

INR 41,000 per tonne in January 2017 to INR 40,000 per tonne in June 2017, by

2.5% during the period. Average Billet prices at INR 33,200 per tonne in January

2017 have come down to INR 31,000 per tonne in June 2017, by 6.4%. These

price trends indicate that Indian domestic prices which had moved up in the period

(particularly the flat categories) immediately following the imposition of MIP,

Safeguard and Anti Dumping duties, have subsequently come down, not very

appreciably, in the last 6 months.

This is not the same for the long products. Sustenance of steel prices in the

domestic prices on a longer basis is dependent on the strength of the market that

can be pepped up either by enhancing investment in building up of physical

infrastructure or by higher industrial growth in steel intensive segments. Now, that

the headline inflation rate has dropped to 0.9% in June 2017, a downward revision

in the Repo rate by RBI by at least 0.5-0.75 basis points in the next quarter can be

well expected. It would partially drive in private corporate investment in

infrastructure and attract more household expenditure in consumer durable sector

and in real estate, especially in the affordable housing component. The

enhancement of public investment in infrastructure that would drive in more private

participation would accomplish the residual drive required to rejuvenate the Indian

steel industry.

-

The 19th China£¨Guangzhou£©Int¡¯l

Sheet metal machinery,Forging, Stamping and Setting Equipment Exhibition

�����������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������ly:"Times New Roman";color:red;background:white''>µ¯»É»ú²©ÀÀ»á

|

|

|

|

|